Credit card transactions are a common and convenient way to make purchases in today’s digital age. However, it is important to understand the ins and outs of credit card transactions to ensure the security of your personal and financial information. This article will provide an overview of credit card transactions, the importance of secure credit card processing, common types of credit card fraud, and best practices for protecting credit card information.

Key Takeaways

- Secure credit card processing is crucial for protecting sensitive information.

- Common types of credit card fraud include identity theft, card skimming, and phishing scams.

- To protect credit card information, always use secure websites and avoid sharing sensitive details over unsecured networks.

- Regularly monitor credit card statements and report any suspicious activity to your bank or credit card issuer.

- Implementing strong password practices and keeping software up to date can help prevent credit card fraud.

Understanding Credit Card Transactions

The Importance of Secure Credit Card Processing

The Importance of Secure Credit Card Processing

Credit card transactions are a crucial part of our business operations. Ensuring the security of these transactions is of utmost importance to protect our customers’ sensitive information. By implementing robust security measures, we can safeguard against potential threats and minimize the risk of credit card fraud.

Common Types of Credit Card Fraud

Common Types of Credit Card Fraud

Credit card fraud is a serious issue that can have significant financial and reputational consequences for businesses. It is important for merchants to be aware of the different types of credit card fraud and take steps to protect themselves and their customers.

One common type of credit card fraud is identity theft, where a fraudster steals someone’s personal information and uses it to make unauthorized purchases. This can happen through various methods, such as phishing scams, data breaches, or physical theft of credit card information.

Another type of credit card fraud is card skimming, where a fraudster uses a device to steal credit card information when the card is swiped or inserted into a card reader. This information can then be used to create counterfeit cards or make fraudulent online purchases.

To protect against credit card fraud, merchants should implement secure payment processing systems and follow best practices for handling and storing credit card information. It is also important to stay updated on the latest fraud prevention techniques and technologies.

Here are some tips to help protect against credit card fraud:

- Use strong passwords and encryption for online transactions.

- Regularly monitor credit card statements for any unauthorized charges.

- Train employees on how to identify and report suspicious transactions.

By taking these precautions, businesses can reduce the risk of credit card fraud and provide a secure environment for their customers.

Best Practices for Protecting Credit Card Information

When it comes to protecting credit card information, we prioritize security and efficiency. Our advanced processing solutions ensure a seamless payment experience for both merchants and customers. We understand the importance of secure credit card processing and offer risk mitigation tools and chargeback protection strategies to safeguard your transactions. Additionally, we provide a range of flexible payment solutions, including alternative methods, to cater to the diverse needs of merchants and customers. With over 250 integrations to major payment gateways, we make managing your credit card processing effortless.

Conclusion

In conclusion, understanding credit card transactions is crucial for businesses and consumers alike. The importance of secure credit card processing cannot be overstated, as it helps prevent common types of credit card fraud. By following best practices for protecting credit card information, businesses can ensure the safety and trust of their customers. It is essential to stay vigilant and implement robust security measures to safeguard sensitive financial data. With the right knowledge and precautions, businesses can confidently navigate the world of credit card transactions and provide a secure environment for their customers.

Frequently Asked Questions

What is a credit card transaction?

A credit card transaction is a process where a customer uses their credit card to make a payment for goods or services.

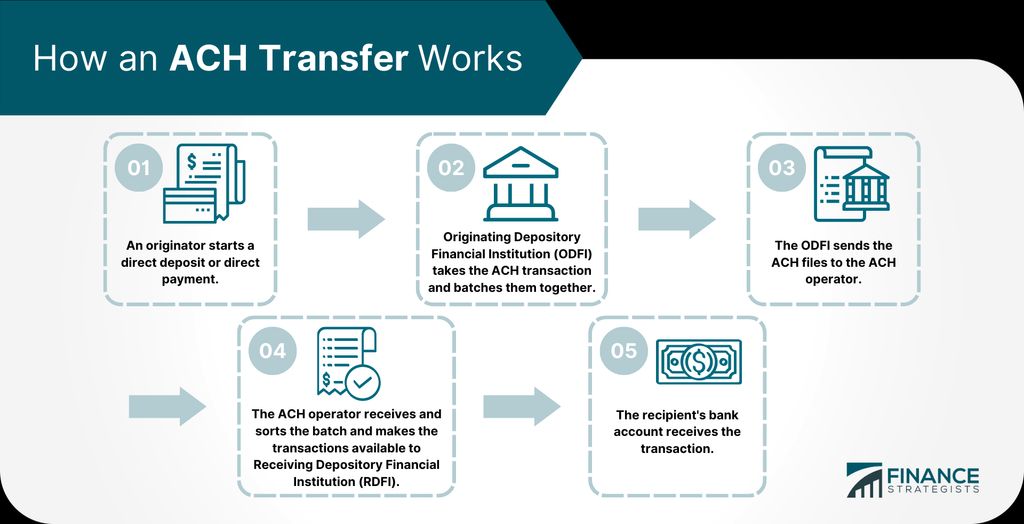

How does a credit card transaction work?

When a customer makes a purchase using a credit card, the merchant sends a request to the credit card network to authorize the transaction. If approved, the funds are transferred from the customer’s credit card account to the merchant’s account.

Is it safe to use a credit card for online transactions?

Using a credit card for online transactions can be safe if certain security measures are in place. It is important to ensure that the website is secure and uses encryption to protect your credit card information.

What should I do if my credit card transaction is declined?

If your credit card transaction is declined, you can contact your credit card issuer to find out the reason for the decline. It could be due to insufficient funds, suspected fraud, or other reasons.

Can I dispute a credit card transaction?

Yes, you can dispute a credit card transaction if you believe it is unauthorized or there is a problem with the goods or services purchased. Contact your credit card issuer to initiate the dispute process.

What are the fees associated with credit card transactions?

The fees associated with credit card transactions can vary depending on the type of card, the merchant’s agreement with the card network, and other factors. Common fees include interchange fees, processing fees, and chargeback fees.