-

Table of Contents

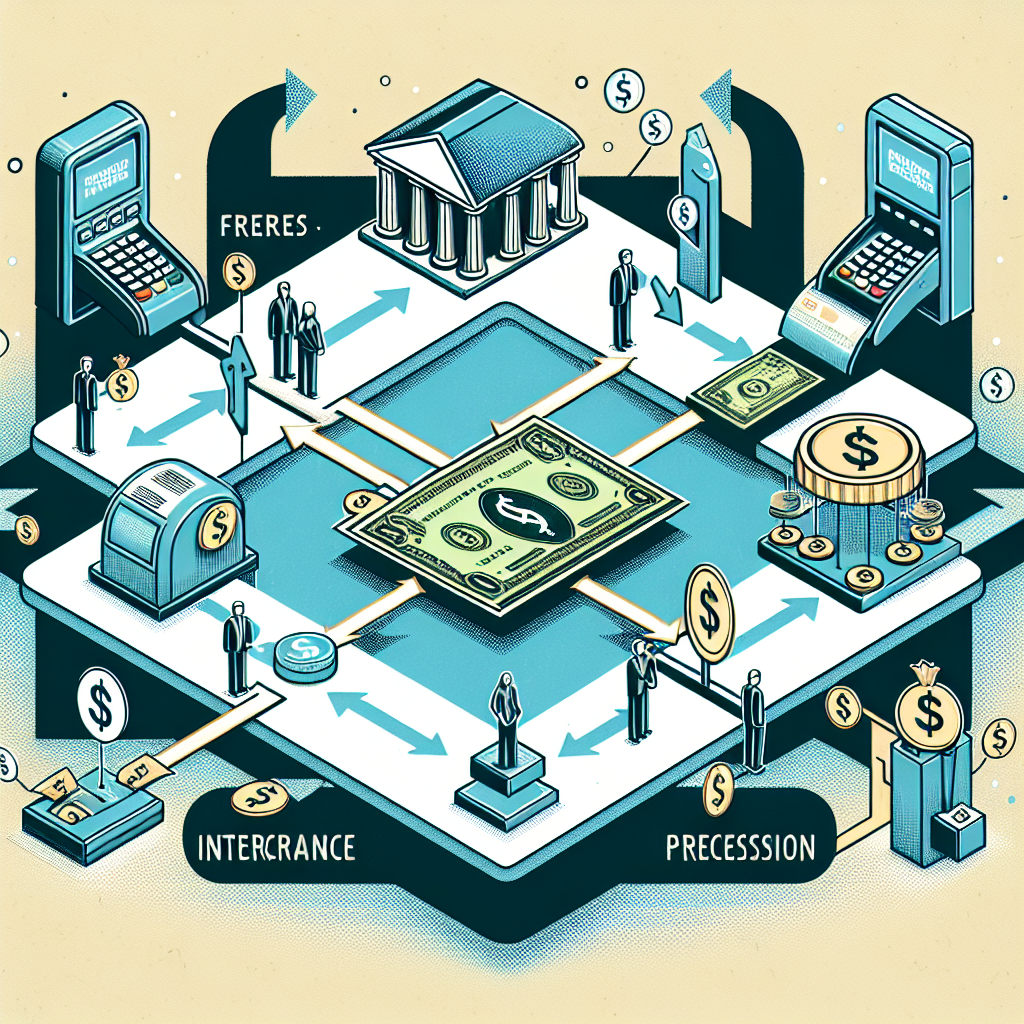

The Basics of Interchange Fees in Payment Processing

Understanding Interchange Fees in Payment Processing

Payment processing is an essential aspect of any business operation, allowing merchants to accept various forms of payment from their customers. However, behind the scenes, there are several fees and charges associated with payment processing that merchants need to be aware of. One such fee is the interchange fee, which plays a crucial role in the payment processing ecosystem.

Interchange fees are charges imposed by credit card networks, such as Visa, Mastercard, and American Express, on merchants for processing credit and debit card transactions. These fees are set by the card networks and are non-negotiable, meaning that all merchants, regardless of their size or industry, must pay them. Understanding how interchange fees work is essential for merchants to effectively manage their payment processing costs.

The interchange fee is typically expressed as a percentage of the transaction value, plus a fixed fee per transaction. The percentage fee is calculated based on the type of card used, the transaction volume, and the merchant’s industry. For example, a higher interchange fee may be charged for a premium rewards card compared to a standard credit card. Similarly, industries with higher risk, such as travel or online gambling, may attract higher interchange fees.

Merchants often wonder why they have to pay interchange fees and why they cannot negotiate them. The primary reason is that interchange fees cover the costs associated with processing card transactions, including fraud prevention, network maintenance, and customer support. These fees also help fund the rewards programs offered by credit card issuers, which incentivize consumers to use their cards more frequently.

It is important to note that interchange fees are not collected by the card networks themselves. Instead, they are passed on to the acquiring bank, which is the financial institution that processes the merchant’s card transactions. The acquiring bank then deducts the interchange fee from the merchant’s account and remits it to the card networks. In some cases, the acquiring bank may also add a markup to the interchange fee as part of their service charges.

Merchants often find it challenging to keep track of the various interchange fees associated with different card types and transaction volumes. To simplify the process, many payment processors offer bundled pricing models, where interchange fees are combined with other fees, such as processing fees and statement fees, into a single rate. This allows merchants to have a clearer understanding of their overall payment processing costs.

While interchange fees are a necessary part of the payment processing ecosystem, merchants can take steps to minimize their impact on their bottom line. One way is to ensure that they are using the correct payment processing technology and software that is optimized for their industry. This can help reduce the risk of chargebacks and fraudulent transactions, which can attract higher interchange fees.

Additionally, merchants can review their pricing structure and negotiate with their payment processor to ensure they are getting the best possible rates. It is also important to regularly monitor and analyze transaction data to identify any patterns or trends that may impact interchange fees. By staying informed and proactive, merchants can effectively manage their payment processing costs and maximize their profitability.

In conclusion, interchange fees are an integral part of payment processing, allowing merchants to accept credit and debit card transactions. Understanding how these fees work and their impact on a merchant’s bottom line is crucial for effective cost management. By staying informed, utilizing the right technology, and negotiating with payment processors, merchants can navigate the complex world of interchange fees and optimize their payment processing operations.

How Interchange Fees Impact Merchants and Consumers

Understanding Interchange Fees in Payment Processing

Payment processing is an essential aspect of any business operation, allowing merchants to accept various forms of payment from their customers. However, behind the scenes, there are numerous fees and charges associated with payment processing that can significantly impact both merchants and consumers. One such fee that plays a crucial role in the payment processing ecosystem is the interchange fee.

Interchange fees are charges imposed by credit card networks, such as Visa and Mastercard, on merchants for accepting their cards as a form of payment. These fees are typically a percentage of the transaction value, with additional fixed fees in some cases. While interchange fees may seem like an additional burden for merchants, they serve a vital purpose in facilitating the smooth functioning of the payment processing system.

One way interchange fees impact merchants is through their effect on the overall cost of accepting credit card payments. Since these fees are a percentage of the transaction value, merchants who frequently process high-value transactions may find themselves paying substantial amounts in interchange fees. This can eat into their profit margins, especially for businesses with low-profit margins to begin with. As a result, merchants often pass on these costs to consumers in the form of higher prices for goods and services.

Moreover, interchange fees can also vary depending on the type of card used for the transaction. Credit cards with rewards programs or premium benefits often have higher interchange fees compared to standard credit cards. This means that merchants accepting these premium cards may face higher costs, further impacting their bottom line. To mitigate these costs, some merchants may choose to impose surcharges on customers who use premium cards or even refuse to accept them altogether.

On the consumer side, interchange fees indirectly impact them through the prices they pay for goods and services. As merchants pass on the costs of interchange fees to consumers, they may experience higher prices when using credit cards for their purchases. This can be particularly noticeable in industries with low-profit margins, such as retail or hospitality, where even a small increase in prices can have a significant impact on consumers’ purchasing power.

However, it is important to note that interchange fees also enable the widespread acceptance of credit cards by merchants. Without these fees, merchants would have little incentive to accept credit cards, as the costs associated with payment processing would outweigh the benefits. This would limit consumers’ payment options and potentially hinder economic growth. Interchange fees, therefore, play a crucial role in maintaining a robust and efficient payment processing system that benefits both merchants and consumers.

In conclusion, interchange fees are an integral part of the payment processing ecosystem, impacting both merchants and consumers. While they can increase the overall cost of accepting credit card payments for merchants, they also enable the widespread acceptance of credit cards, providing convenience and flexibility to consumers. Understanding the role of interchange fees is essential for businesses and consumers alike, as it allows for informed decision-making regarding payment methods and pricing strategies.

Understanding the Different Types of Interchange Fees

Understanding Interchange Fees in Payment Processing

Payment processing is an essential aspect of any business that accepts credit or debit card payments. However, many business owners may not be familiar with the intricacies of payment processing, particularly when it comes to interchange fees. Interchange fees are a crucial component of the payment processing ecosystem, and understanding the different types of interchange fees is essential for businesses to make informed decisions.

Interchange fees are fees that are charged by the card-issuing bank to the merchant’s acquiring bank for each transaction. These fees are set by the card networks, such as Visa, Mastercard, and American Express, and are meant to cover the costs associated with processing the transaction and managing the risk involved. Interchange fees are typically expressed as a percentage of the transaction amount, plus a flat fee.

There are several different types of interchange fees, each with its own characteristics and implications for businesses. The most common type of interchange fee is the “qualified” fee. Qualified fees are the lowest interchange fees and are typically charged for transactions that meet certain criteria, such as being swiped in person and using a standard credit card. These fees are generally the most favorable for businesses, as they are lower than other interchange fee categories.

On the other end of the spectrum, there are “non-qualified” fees. Non-qualified fees are the highest interchange fees and are typically charged for transactions that do not meet the criteria for qualified fees. This can include transactions that are manually keyed in, transactions involving rewards or corporate cards, or transactions that are not settled within a certain timeframe. Non-qualified fees can significantly impact a business’s bottom line, as they are higher than qualified fees.

In addition to qualified and non-qualified fees, there are also “mid-qualified” fees. Mid-qualified fees fall somewhere in between qualified and non-qualified fees and are typically charged for transactions that meet some, but not all, of the criteria for qualified fees. For example, a transaction that is swiped in person but involves a rewards card may be subject to a mid-qualified fee. These fees are generally higher than qualified fees but lower than non-qualified fees.

It’s important for businesses to understand the different types of interchange fees because they can have a significant impact on profitability. By optimizing their payment processing setup and ensuring that the majority of transactions qualify for the lowest interchange fees, businesses can save money and improve their bottom line. This can be achieved through various strategies, such as using the right payment processing provider, implementing best practices for card acceptance, and leveraging technology to streamline operations.

In conclusion, interchange fees are a critical aspect of payment processing that businesses need to understand. By familiarizing themselves with the different types of interchange fees, businesses can make informed decisions and optimize their payment processing setup. Qualified fees are the most favorable, while non-qualified fees are the highest. Mid-qualified fees fall in between. By optimizing their payment processing setup and ensuring that the majority of transactions qualify for the lowest interchange fees, businesses can save money and improve profitability.

Strategies to Reduce Interchange Fees for Businesses

Understanding Interchange Fees in Payment Processing

In the world of business, payment processing is an essential component of any successful operation. Whether it’s a brick-and-mortar store or an online business, the ability to accept payments from customers is crucial. However, many business owners may not be aware of the various fees associated with payment processing, particularly interchange fees. Interchange fees are charges imposed by credit card companies and banks for the privilege of accepting credit card payments. These fees can significantly impact a business’s bottom line, so it’s important for business owners to understand them and explore strategies to reduce them.

Interchange fees are a percentage of each transaction that is paid to the credit card company or bank. They are typically based on a variety of factors, including the type of card used, the type of transaction (e.g., in-person or online), and the risk associated with the transaction. The fees can vary widely, ranging from as low as 1% to as high as 3% or more. For businesses that process a large volume of credit card transactions, these fees can quickly add up and eat into profits.

One strategy that businesses can employ to reduce interchange fees is to negotiate with their payment processor. Payment processors act as intermediaries between businesses and credit card companies, facilitating the acceptance of credit card payments. By negotiating with their payment processor, businesses may be able to secure lower interchange fees. This can be particularly effective for businesses that have a high volume of transactions or a strong negotiating position.

Another strategy to reduce interchange fees is to implement a cash discount program. Cash discount programs allow businesses to offer a discount to customers who pay with cash, while charging a slightly higher price for customers who pay with a credit card. By doing so, businesses can offset some of the interchange fees associated with credit card transactions. However, it’s important to note that cash discount programs must comply with applicable laws and regulations, so businesses should consult with legal counsel before implementing such a program.

Businesses can also explore alternative payment methods to reduce interchange fees. For example, some payment processors offer lower fees for transactions made with debit cards or electronic checks. By encouraging customers to use these alternative payment methods, businesses can potentially reduce their interchange fees. Additionally, businesses can consider accepting payments through digital wallets or mobile payment apps, which may offer lower fees compared to traditional credit card transactions.

Lastly, businesses can take steps to minimize the risk associated with credit card transactions, which can help reduce interchange fees. This can include implementing fraud prevention measures, such as requiring customers to provide additional verification information or using address verification systems. By reducing the risk of fraudulent transactions, businesses may be able to negotiate lower interchange fees with their payment processor.

In conclusion, understanding interchange fees in payment processing is crucial for businesses looking to optimize their financial performance. By exploring strategies to reduce interchange fees, such as negotiating with payment processors, implementing cash discount programs, exploring alternative payment methods, and minimizing transaction risk, businesses can potentially save significant amounts of money. It’s important for business owners to stay informed about the latest developments in payment processing and to regularly review their payment processing agreements to ensure they are getting the best possible rates. By doing so, businesses can maximize their profits and improve their overall financial health.

The Future of Interchange Fees in the Payment Processing Industry

The payment processing industry is constantly evolving, with new technologies and regulations shaping the way transactions are conducted. One aspect of payment processing that has garnered significant attention is interchange fees. Interchange fees are the fees paid by merchants to card issuers for the privilege of accepting credit and debit cards as a form of payment. These fees are an essential component of the payment processing ecosystem, as they help cover the costs associated with processing transactions and managing the risks involved.

However, interchange fees have been a subject of controversy and debate in recent years. Critics argue that these fees are too high and place an undue burden on merchants, particularly small businesses. They argue that interchange fees eat into their profit margins and make it difficult for them to compete with larger retailers. On the other hand, proponents of interchange fees argue that they are necessary to ensure the smooth functioning of the payment processing system. They contend that these fees help cover the costs of fraud prevention, customer service, and technology investments made by card issuers.

The future of interchange fees in the payment processing industry is uncertain. Regulatory bodies around the world have taken notice of the concerns raised by merchants and consumers and have started to take action. In the European Union, for example, interchange fees for debit and credit card transactions have been capped to ensure that they are reasonable and proportionate. This move has been welcomed by merchants, who hope that it will lead to lower costs and increased competition in the payment processing industry.

In the United States, interchange fees have also come under scrutiny. The Durbin Amendment, which was part of the Dodd-Frank Wall Street Reform and Consumer Protection Act, mandated that debit card interchange fees be reasonable and proportional to the cost incurred by issuers. This has led to a reduction in interchange fees for debit card transactions, much to the delight of merchants. However, credit card interchange fees remain a contentious issue, with merchants continuing to push for further regulation and oversight.

The rise of alternative payment methods, such as mobile wallets and digital currencies, also poses a challenge to the traditional interchange fee model. These new payment methods offer lower transaction costs and greater convenience for both merchants and consumers. As a result, some experts predict that interchange fees may become less relevant in the future, as merchants and consumers shift towards these alternative payment methods.

Despite the challenges and uncertainties surrounding interchange fees, it is clear that they play a crucial role in the payment processing industry. They help ensure the smooth functioning of the system and enable merchants to accept credit and debit cards as a form of payment. However, it is important to strike a balance between the needs of merchants and the costs incurred by card issuers. Regulatory bodies must continue to monitor and regulate interchange fees to ensure that they are reasonable and fair.

In conclusion, interchange fees are an integral part of the payment processing industry. They help cover the costs associated with processing transactions and managing risks. However, they have come under scrutiny in recent years, with merchants and consumers calling for greater regulation and oversight. The future of interchange fees is uncertain, with regulatory bodies around the world taking action to address the concerns raised. The rise of alternative payment methods also poses a challenge to the traditional interchange fee model. Despite these challenges, interchange fees will continue to play a crucial role in the payment processing industry, ensuring the smooth functioning of the system.

Q&A

1. What are interchange fees in payment processing?

Interchange fees are fees charged by credit card networks to payment processors for facilitating transactions between merchants and cardholders.

2. Who sets interchange fees?

Interchange fees are set by credit card networks such as Visa, Mastercard, and American Express.

3. How are interchange fees calculated?

Interchange fees are calculated based on various factors, including the type of card used, the transaction amount, and the merchant’s industry.

4. Why do interchange fees exist?

Interchange fees exist to cover the costs associated with processing credit card transactions, including fraud prevention, network infrastructure, and customer support.

5. Who pays interchange fees?

Interchange fees are typically paid by the merchant’s payment processor, who then passes on the cost to the merchant. Ultimately, the cost may be reflected in the prices charged to customers.