-

Table of Contents

What is a Payment Gateway?

In the world of e-commerce, payment processing is a crucial aspect of any business. It is essential to understand the difference between a payment gateway and a payment processor to ensure smooth and secure transactions. While these terms are often used interchangeably, they refer to distinct components of the payment process.

A payment gateway is a technology that acts as a bridge between the customer and the merchant. It securely captures and encrypts the customer’s payment information, such as credit card details, and transmits it to the payment processor for authorization. Think of it as a virtual point-of-sale terminal that facilitates the transfer of funds from the customer’s account to the merchant’s account.

Payment gateways provide a secure environment for online transactions by encrypting sensitive data and protecting it from unauthorized access. They also offer additional features such as fraud detection and prevention tools, recurring billing options, and support for multiple payment methods. Popular payment gateways include PayPal, Stripe, and Authorize.Net.

On the other hand, a payment processor is a financial institution or service provider that handles the actual transaction. It is responsible for verifying the customer’s payment details, checking for available funds, and transferring the money from the customer’s account to the merchant’s account. Payment processors work behind the scenes, ensuring that the transaction is completed smoothly and securely.

Payment processors are connected to various payment networks, such as Visa, Mastercard, and American Express, allowing them to process transactions from different card issuers. They also handle other types of payments, such as bank transfers and digital wallets. Some well-known payment processors include Square, Stripe, and Braintree.

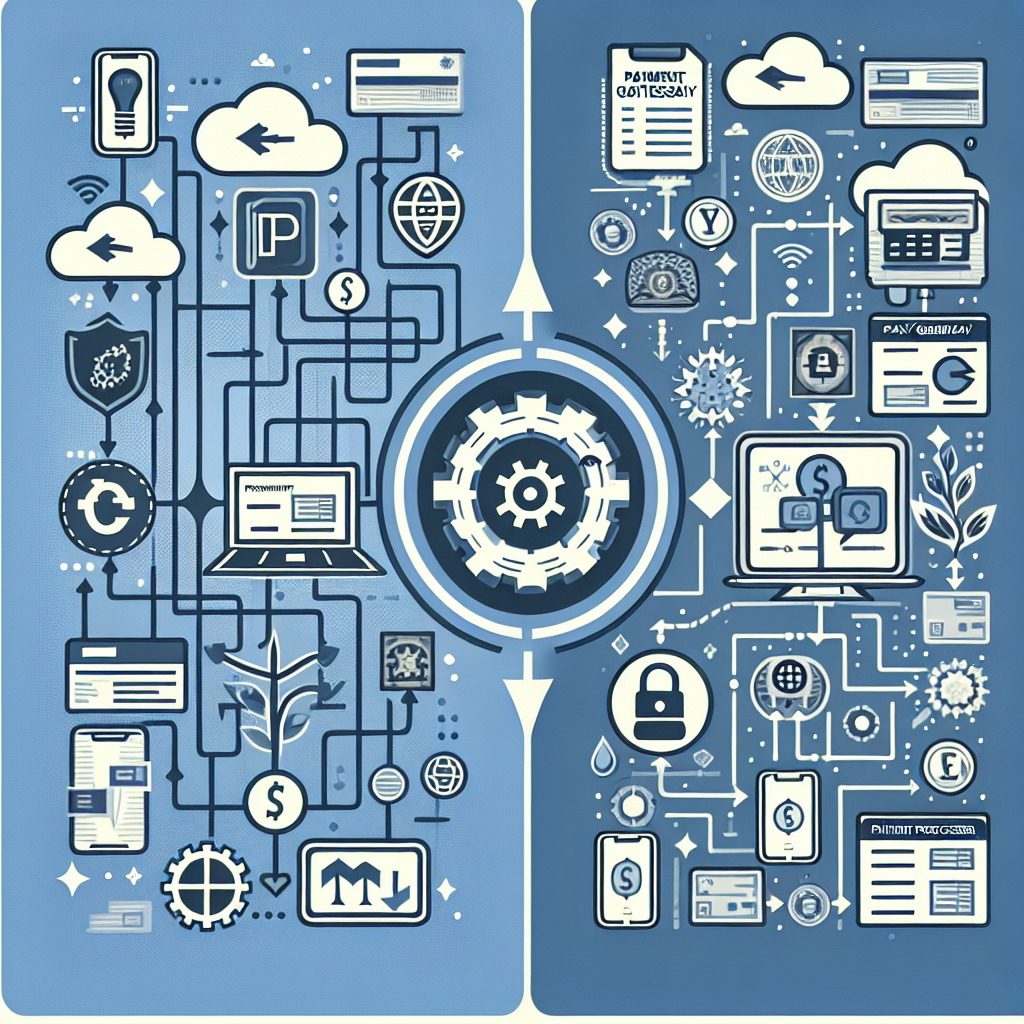

While payment gateways and payment processors work together to facilitate online payments, they serve different purposes. The payment gateway focuses on securely transmitting the customer’s payment information, while the payment processor handles the actual transaction. In simpler terms, the payment gateway is the front-end technology, and the payment processor is the back-end financial institution.

To illustrate this further, let’s consider an online purchase scenario. When a customer adds items to their shopping cart and proceeds to checkout, they are directed to a payment gateway. The payment gateway securely collects the customer’s payment information and sends it to the payment processor for verification and processing. Once the payment is authorized, the payment processor transfers the funds from the customer’s account to the merchant’s account.

In summary, understanding the difference between a payment gateway and a payment processor is crucial for any business involved in e-commerce. The payment gateway acts as a secure bridge between the customer and the merchant, while the payment processor handles the actual transaction. By working together, these components ensure smooth and secure online payments, providing a seamless experience for both customers and merchants.

What is a Payment Processor?

In the world of e-commerce, payment processing is a crucial aspect that businesses need to understand. It involves the handling of financial transactions between a customer and a merchant, ensuring that payments are securely and efficiently processed. However, the terms “payment gateway” and “payment processor” are often used interchangeably, leading to confusion among business owners. To clarify this confusion, it is important to understand the difference between these two terms.

A payment processor is a company or service that handles the technical aspects of payment processing. It acts as an intermediary between the merchant and the customer’s bank, facilitating the transfer of funds. When a customer makes a purchase, the payment processor securely collects the payment information, such as credit card details, and sends it to the customer’s bank for authorization. Once the payment is authorized, the processor transfers the funds from the customer’s bank account to the merchant’s account.

Payment processors play a vital role in ensuring the security and reliability of payment transactions. They are responsible for encrypting and protecting sensitive customer data, such as credit card numbers, to prevent fraud and unauthorized access. Additionally, payment processors often offer additional services, such as fraud detection and prevention tools, to help merchants mitigate the risks associated with online payments.

There are several well-known payment processors in the market, including PayPal, Stripe, and Square. These companies have built their reputation on providing reliable and secure payment processing services to businesses of all sizes. They offer easy integration with e-commerce platforms and provide merchants with detailed transaction reports and analytics.

On the other hand, a payment gateway is a software application that connects the merchant’s website or mobile app to the payment processor. It acts as a bridge between the customer, the merchant, and the payment processor, facilitating the flow of information and funds. When a customer makes a purchase on a merchant’s website, the payment gateway securely collects the payment information and sends it to the payment processor for authorization. Once the payment is authorized, the gateway informs the merchant, allowing them to complete the transaction.

Payment gateways are responsible for ensuring the smooth and secure transmission of payment data between the customer, the merchant, and the payment processor. They encrypt the data to protect it from unauthorized access and provide a seamless user experience by offering various payment options, such as credit cards, digital wallets, and bank transfers. Additionally, payment gateways often provide merchants with features like recurring billing and subscription management, making it easier to handle recurring payments.

Popular payment gateway providers include Authorize.Net, Braintree, and 2Checkout. These companies offer easy integration with various e-commerce platforms and provide merchants with customizable payment pages to match their brand identity. They also offer robust security features, such as tokenization and fraud detection, to protect both the merchant and the customer.

In conclusion, while the terms “payment gateway” and “payment processor” are often used interchangeably, they refer to different components of the payment processing ecosystem. A payment processor handles the technical aspects of payment processing, while a payment gateway connects the merchant’s website or app to the payment processor. Both are essential for facilitating secure and efficient payment transactions in the world of e-commerce. Understanding the difference between these two terms is crucial for businesses looking to establish a reliable and secure payment processing system.

Key Differences between Payment Gateway and Payment Processor

Payment Gateway vs. Payment Processor: Understanding the Difference

In the world of online transactions, payment gateways and payment processors play crucial roles. However, many people often confuse these two terms or use them interchangeably. While they are both essential components of online payments, it is important to understand the key differences between them.

Firstly, let’s define what a payment gateway is. A payment gateway is a technology that securely authorizes and processes online transactions between a merchant and a customer. It acts as a virtual point-of-sale terminal, encrypting sensitive payment information and transmitting it securely between the customer’s device and the merchant’s payment processor. In simpler terms, a payment gateway is the bridge that connects the customer’s payment information to the payment processor.

On the other hand, a payment processor is a financial institution or a third-party company that facilitates the actual movement of funds during a transaction. It is responsible for verifying the customer’s payment details, checking for sufficient funds, and transferring the money from the customer’s account to the merchant’s account. In essence, the payment processor is the entity that handles the actual transfer of funds.

Now that we have a basic understanding of what a payment gateway and a payment processor are, let’s delve into the key differences between them.

One major difference lies in their respective functions. A payment gateway primarily focuses on the security aspect of the transaction. It encrypts and securely transmits the customer’s payment information, ensuring that it remains confidential and protected from unauthorized access. On the other hand, a payment processor focuses on the financial aspect of the transaction. It verifies the payment details, checks for fraud, and facilitates the movement of funds between the customer and the merchant.

Another difference is their level of involvement in the transaction process. A payment gateway is involved in every step of the transaction, from the moment the customer enters their payment information to the final authorization of the payment. It acts as the intermediary between the customer, the merchant, and the payment processor. In contrast, a payment processor is only involved once the payment gateway has securely transmitted the payment information. It takes over from there, handling the financial aspects of the transaction.

Furthermore, the relationship between a merchant and a payment gateway differs from that between a merchant and a payment processor. A payment gateway is typically integrated into a merchant’s website or online platform, allowing customers to make payments seamlessly. The merchant pays a fee to the payment gateway provider for this service. On the other hand, a payment processor is a separate entity that the merchant contracts with to handle their payment transactions. The merchant pays a fee to the payment processor for their services, which may include transaction fees, monthly fees, or other charges.

In conclusion, while payment gateways and payment processors are both essential components of online transactions, they serve different functions and have distinct roles. A payment gateway focuses on the security aspect of the transaction, ensuring the safe transmission of payment information, while a payment processor handles the financial aspects, facilitating the movement of funds. Understanding these differences is crucial for businesses and consumers alike, as it helps in choosing the right payment solution for their specific needs.

Benefits of using a Payment Gateway

When it comes to online transactions, businesses need a reliable and secure way to process payments. This is where payment gateways come into play. A payment gateway is a technology that allows businesses to accept payments from customers through various channels, such as websites or mobile apps. It acts as a bridge between the customer’s payment method and the merchant’s bank account.

One of the key benefits of using a payment gateway is the enhanced security it provides. Payment gateways use encryption technology to protect sensitive customer information, such as credit card details, during the transaction process. This ensures that customer data is kept safe and reduces the risk of fraud or data breaches. By using a payment gateway, businesses can build trust with their customers and provide a secure environment for online transactions.

Another advantage of using a payment gateway is the convenience it offers to both businesses and customers. With a payment gateway, businesses can accept payments from customers around the world, regardless of their location or time zone. This opens up new opportunities for businesses to expand their customer base and reach a global audience. Customers, on the other hand, can enjoy a seamless and hassle-free payment experience, as they can make payments using their preferred payment method, whether it’s a credit card, debit card, or digital wallet.

Payment gateways also provide businesses with valuable insights and analytics. By integrating a payment gateway into their systems, businesses can track and analyze transaction data, such as sales volume, customer behavior, and payment trends. This information can help businesses make informed decisions and optimize their payment processes. For example, businesses can identify popular payment methods among their customers and tailor their payment options accordingly. They can also identify any bottlenecks or issues in the payment process and take steps to improve efficiency.

Furthermore, payment gateways offer businesses the flexibility to customize their payment processes according to their specific needs. Businesses can choose from a range of features and functionalities offered by payment gateways, such as recurring billing, subscription management, and multi-currency support. This allows businesses to cater to different customer preferences and adapt to changing market demands. For example, businesses can set up recurring billing for subscription-based services, making it easier for customers to make regular payments without the need for manual intervention.

In conclusion, payment gateways offer numerous benefits to businesses looking to process payments online. From enhanced security to global reach, convenience, and valuable insights, payment gateways provide businesses with the tools they need to streamline their payment processes and provide a seamless experience for their customers. By understanding the difference between payment gateways and payment processors, businesses can make informed decisions and choose the right solution that meets their specific requirements. Ultimately, investing in a reliable payment gateway is crucial for businesses looking to thrive in the digital age and stay ahead of the competition.

Benefits of using a Payment Processor

Benefits of using a Payment Processor

When it comes to processing payments for your business, using a payment processor can offer numerous benefits. A payment processor is a company that handles the transaction between the customer and the merchant, ensuring that the payment is securely processed. Unlike a payment gateway, which simply acts as a bridge between the customer and the merchant’s bank, a payment processor takes on a more active role in the payment process.

One of the key benefits of using a payment processor is the added layer of security it provides. Payment processors are equipped with advanced fraud detection tools and encryption technology, which helps protect both the customer’s sensitive information and the merchant’s financial data. By using a payment processor, businesses can minimize the risk of fraudulent transactions and safeguard their customers’ trust.

Another advantage of using a payment processor is the ability to accept a wide range of payment methods. Whether it’s credit cards, debit cards, mobile payments, or even cryptocurrencies, a payment processor can handle them all. This flexibility allows businesses to cater to a broader customer base and increase their sales potential. By offering multiple payment options, businesses can accommodate the preferences of their customers and provide a seamless checkout experience.

Furthermore, payment processors often offer additional features and services that can streamline the payment process. For instance, many payment processors provide recurring billing options, which are particularly useful for businesses that offer subscription-based services. With recurring billing, customers can set up automatic payments, eliminating the need for manual transactions and reducing the risk of missed payments. This feature not only saves time for both the customer and the merchant but also ensures a steady stream of revenue for the business.

Payment processors also offer robust reporting and analytics tools, allowing businesses to gain valuable insights into their sales performance. By analyzing transaction data, businesses can identify trends, track customer behavior, and make informed decisions to optimize their operations. This data-driven approach can help businesses identify areas for improvement, refine their marketing strategies, and ultimately increase their profitability.

In addition to these benefits, payment processors often provide excellent customer support. Whether it’s technical assistance or help with account management, businesses can rely on the expertise of payment processor representatives to resolve any issues promptly. This level of support is crucial for businesses, as it ensures a smooth payment process and minimizes disruptions to their operations.

In conclusion, using a payment processor offers several advantages for businesses. From enhanced security measures to a wide range of payment options, payment processors provide the necessary tools to streamline the payment process and improve the overall customer experience. With additional features such as recurring billing and robust reporting tools, businesses can optimize their operations and make data-driven decisions. Furthermore, the reliable customer support provided by payment processors ensures that businesses can resolve any issues promptly and maintain a seamless payment process. By understanding the benefits of using a payment processor, businesses can make informed decisions and choose the right payment solution for their needs.

Q&A

1. What is a payment gateway?

A payment gateway is a software application that securely authorizes and processes online transactions between a customer and a merchant.

2. What is a payment processor?

A payment processor is a financial institution or service provider that facilitates the transfer of funds between the customer’s bank and the merchant’s bank.

3. What is the main difference between a payment gateway and a payment processor?

The main difference is that a payment gateway focuses on the security and authorization of online transactions, while a payment processor handles the actual transfer of funds between banks.

4. How do they work together?

A payment gateway securely collects and encrypts customer payment information, then sends it to the payment processor for verification and transfer of funds.

5. Can a payment gateway and payment processor be the same entity?

Yes, some companies offer both payment gateway and payment processing services, allowing merchants to use a single provider for their online payment needs.